riverside county tax collector mobile home

Welcome to the Riverside County Property Tax Portal. They can be reached at 760 237-7808 or 951 782-4431.

Riverside County Planning Department Frequently Asked Questions

Even if a park model or licensed manufacturedmobile home itself is not assessed any existing or added items such as awnings additions stairs decking skirting concreteasphalt slabs are taxable will be part of the structural component of the taxes.

. Mobile Home Ombudsman is required to assist in the resolution of manufactured housing problems. Searches and payment options are available for the following. We accept the following forms of payment.

All tax bills paid online or by the automated phone system are due by midnight on the delinquent date. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The Assessors primary responsibility is to value taxable property.

Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. Property Tax Frequently Asked Questions. Mobilehome Tax Clearance Certificates.

Riverside County CA currently has 3305 tax liens available as of April 22. Taking its name from the City of Riverside Riverside County was formed in 1893 from a small portion of San Bernardino County and a larger part of San Diego County. Please be advised that if for any reason you are unable to make your tax payment in an automated fashion over the phone or web you are still responsible to make payment timely in order to avoid penalties.

The median property tax in Riverside County California is 2618 per year for a home worth the median value of 325300. The Tax Collector is responsible for the billing and collection of secured unsecured supplemental transient occupancy tax as well as various other special assessments for the county school. The Assessor must complete.

OFFICE OF THE TREASURER-TAX COLLECTOR. Riverside County collects on average 08 of a propertys assessed fair market value as property tax. There are 3 Treasurer Tax Collector Offices in Riverside County California serving a population of 2355002 people in an area of 7205 square miles.

Riverside County Treasurer Attn. It is our hope that this directory will assist in locating the site. The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce taxpayers to the organizations that handle the property tax process in Riverside County.

County Tax Collector Contacts. Following receipt of this information the Tax Collector performs a search of the tax rolls to verify that mobilehome assessments exist for each applicable tax year following the date the mobilehome was originally entered on the Countys tax rolls. Riverside County has one of the highest median property taxes in the United States and is ranked 248th of the 3143.

The county most of the countys incorporated cities school districts and all other taxing agencies located in the county including special districts eg flood control districts sanitation districts. Welcome to the County of Riverside Assessor Online Services. You can search by Assessment Number or situs address.

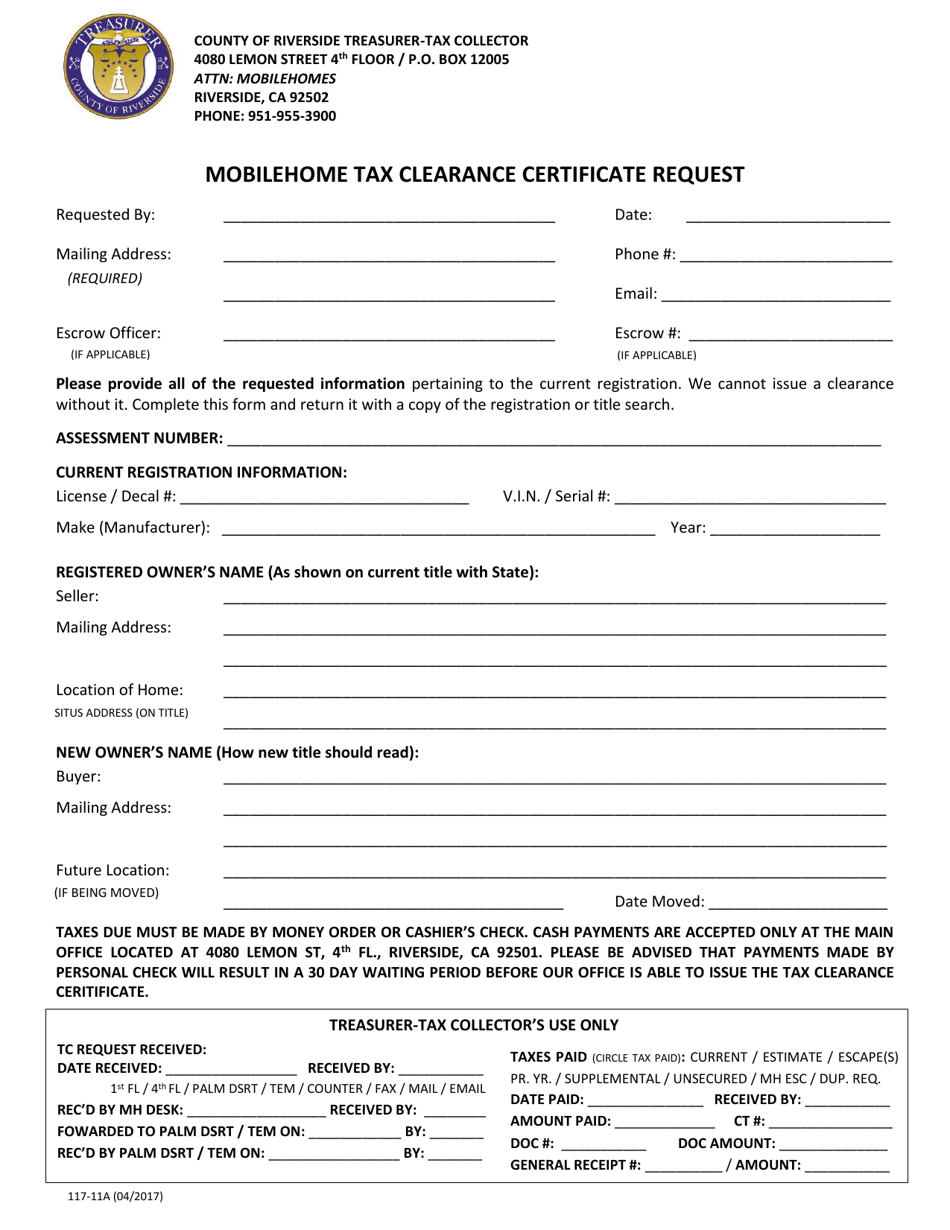

Hi the tax clearance certificate is a certificate used by the revenue of. Should you wish to contact the Tax Office concerning this matter please telephone 951 955-3900. From previous request Partial Decal number accepted.

951 955-6200 Live Agents from 8 am - 5 pm M-F Click Here to Contact Us. There is 1 Treasurer Tax Collector Office per 785000 people and 1 Treasurer Tax Collector Office per 2401 square miles. Box 12005 Riverside CA 92502-2205.

Click Here to request a Mobile Home Tax Clearance Certificate. For a list of county tax collectors and contact information. Yearly median tax in Riverside County.

Ad Uncover Available Property Tax Data By Searching Any Address. We accept mailed payments as timely if. 1234 will find all Decals such as xxx 1234.

Fill out the form below to check the status of your clearance certificate if you have previously made a request on this website. Riverside County Assessor-County Clerk-Recorder Office Hours Locations Phone. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest.

Greater Palm Springs Tourism Business Improvement District GPSTBID Short Term Vacation Rentals. Find out more about our county history or take a history tour with our award-winning Historic Riverside County mobile app featuring more than 120 historic sites. In California Riverside County is ranked 51st of 58 counties in Treasurer.

They are a valuable tool for the real estate industry offering both. The Assessor determines a value for all taxable property and applies all legal exemptions and exclusions. We Provide Homeowner Data Including Property Tax Liens Deeds More.

Monday-Friday 800 AM 400 PM. The Riverside County Tax Collector is a state mandated function that is governed by the California Revenue Taxation Code Government Code and the Code of Civil Procedures. If you have further questions please contact our office at 951955-3900 or e-mail your questions to.

Property taxes are collected by the county although they are governed by California State LawThe Tax Collector of Riverside County collects taxes on behalf of the following entities. The Riverside County Treasurer - Tax Collector is proud to offer online payment services. They are maintained by various government offices in Riverside County California State and at the Federal level.

Riverside District Office 3737 Main Street Suite 400 Riverside CA 92501-3337 Phone. Tax Cycle Calendar and Important Dates to Remember. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Riverside County CA at tax lien auctions or online distressed asset sales.

Find and bid on Residential Real Estate in Riverside County CA. The Assessor locates all taxable property in Riverside County identifies the owners and describes the property. Search our database of Riverside County Property Auctions for free.

The riverside county tax collector was of 2010 don kent who also fulfills in this respect some of the issues which are addressed by riverside county tax collector don kent include such matters as mobilehome tax clearance certificates how to pay your taxes property tax information and. If the mobilehome is currently registered within Riverside County Click HERE to find your Property Tax Account. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites.

.png?ver=2021-05-13-110507-210)

County Mental Health Triage Services

Riverside County Ca Property Tax Search And Records Propertyshark

Supervisor Perez Proud Of California State Budget That Bolsters Local Priorities

Riverside County Ca Property Tax Search And Records Propertyshark

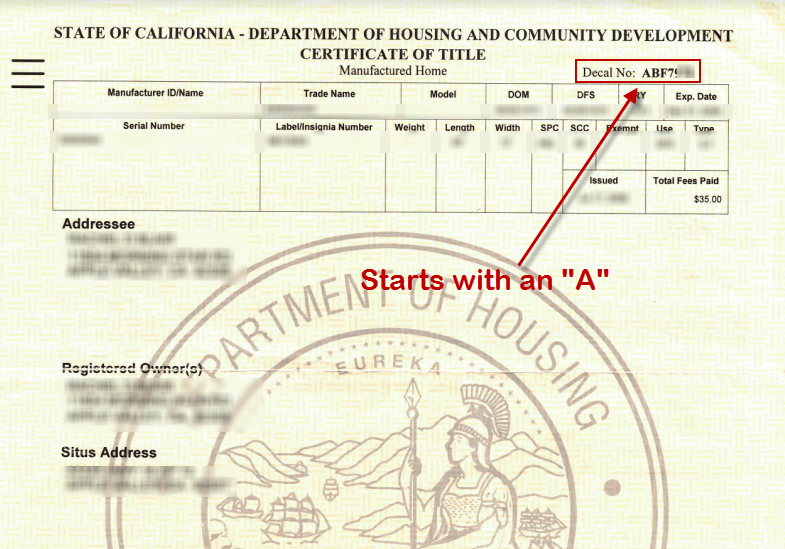

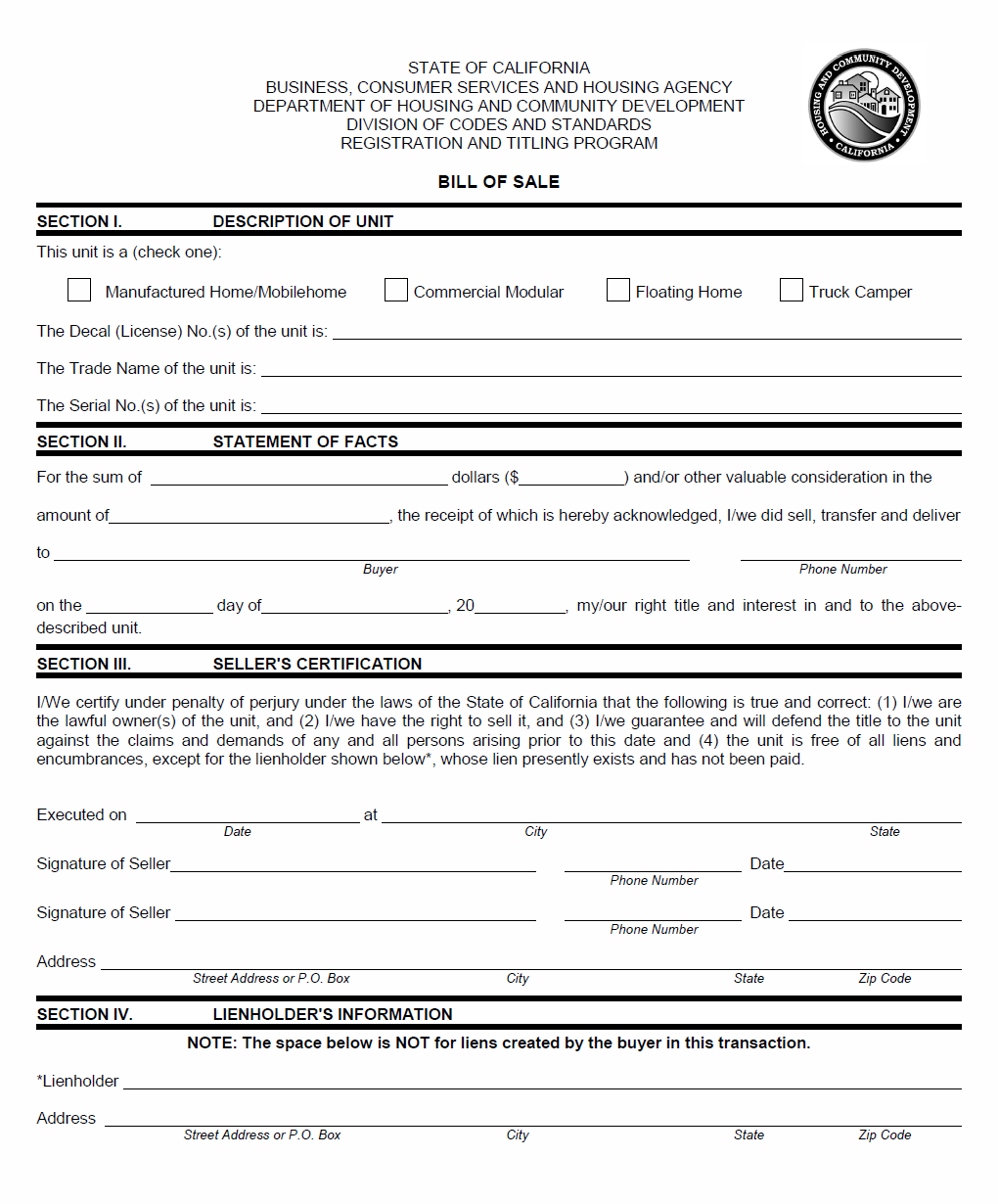

How To Transfer A Mobile Home Title In California Mobile Home Investing

Understanding California S Property Taxes

489 Mobile Home Parks Near Riverside County Ca Mhvillage

How To Transfer A Mobile Home Title In California Mobile Home Investing

Non Receipt Of Title To Mobile Home Ksfg Scm Mobile Home Parks

Meet Your Treasurer Tax Collector

Planning News Supervisor First District Kevin Jeffries

How To Transfer A Mobile Home Title In California Mobile Home Investing

Form 117 11a Download Fillable Pdf Or Fill Online Mobilehome Tax Clearance Certificate Request 2017 Riverside County Templateroller

Riverside County Ca Property Tax Search And Records Propertyshark